SACCO better known as Savings and Credit Cooperative Organizations play a crucial role in Uganda’s financial landscape. They provide financial services and empowerment to their members. SACCOs have tax obligations that need to be understood and fulfilled. Therefore, this blog post explores the specific tax considerations that SACCOs in Uganda should be aware of. Additionally, it shows how the Uganda Revenue Authority (URA) handles taxation for these cooperative organizations.

SACCO Tax Classification and Income Tax Obligations

SACCOs in Uganda are classified as cooperative societies and are subject to specific tax regulations. Cooperative societies are entities that operate with the purpose of creating mutual benefit for their members. They promote thrift, and providing financial services. However, SACCOs also enjoy certain tax exemptions and incentives under this classification.

Despite enoying tax exemptions, it is neccessary for SACCOs to pay income tax on their net surplus or profits. One can obtain the income tax rate applicable to SACCOs from the Income Tax Act. However, SACCOs registered as cooperative societies may be eligible for tax exemptions. This applies on non-commercial income, such as interest on member deposits, dividends from investments. Moreover it applies on grants received for cooperative development purposes.

Withholding Tax Requirement as a SACCO

Moreover, SACCOs may also have withholding tax obligations. This tax is deductable at the source from certain payments SACCOs make to suppliers, contractors, or professionals. The withholding tax rates vary depending on the nature of the payment and the tax status of the recipient.

Does A SACCO pay Value-Added Tax (VAT)?

SACCOs engaged in commercial activities or providing taxable services need to register for Value-Added Tax (VAT) purposes. They must charge VAT on taxable supplies and remit the collected VAT to the URA periodically. However, SACCOs should ensure that they meet the VAT registration threshold and comply with the relevant VAT regulations.

Compliance and Record-Keeping for SACCOs

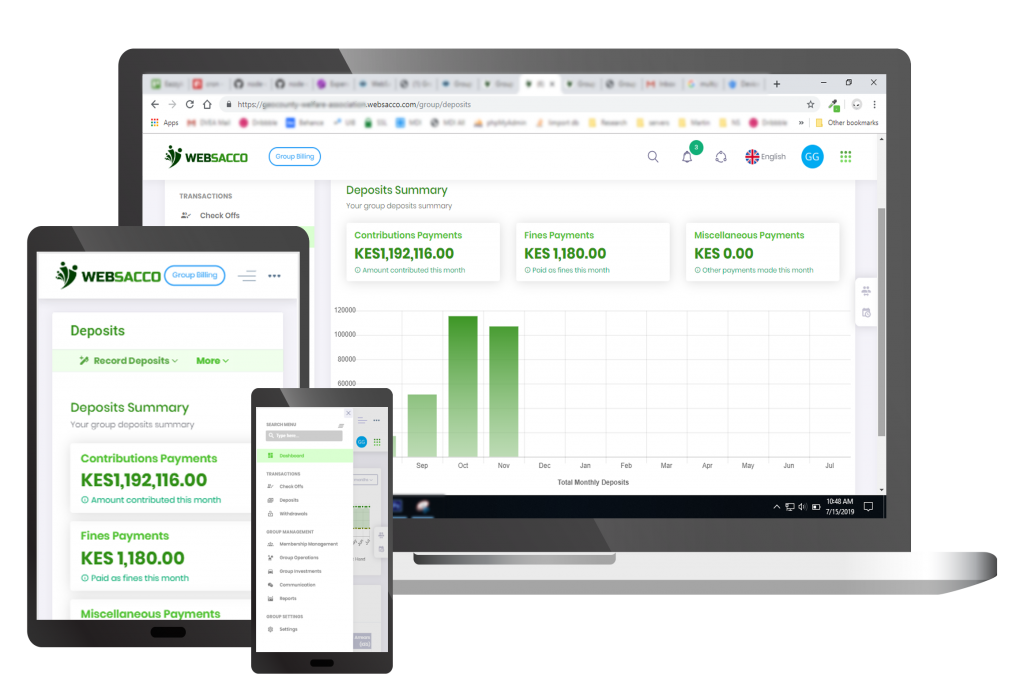

Additionally, it is important to ensure the SACCO is in compliance with tax regulations. Therefore, SACCOs must maintain accurate financial records and proper bookkeeping. This includes income and expenditure statements, balance sheets, invoices, receipts, and other relevant documents. Additionally, It is important to retain these records for the specified period as required by the URA. We recommend using a SACCO management software such as WEBSACCO to ensure proper record keeping. Moreover the site does all the accounting for you therefore minimizing accounting errors and making work easier for your SACCO.

Additional Tax Details for SACCOs

Navigating tax obligations can be complex. Therefore it is advisable for SACCOs to seek professional advice from tax experts or consultants. Furthermore, these professionals can provide guidance on tax planning, compliance. Additionally, they advise on any changes in tax laws or regulations that may affect SACCOs.

Conclusion

Conclusively, understanding the tax obligations for SACCOs is crucial for compliance and financial sustainability. The URA plays a significant role in overseeing taxation for cooperative organizations in Uganda. Additionally, SACCOs should familiarize themselves with the specific tax classification. They include, income tax obligations, withholding tax requirements. Additionally, it includes VAT regulations applicable to their operations. Therefore, by staying informed and seeking professional advice, SACCOs can effectively manage their tax obligations. Consequently this contributes to their long-term success.