Start and run a SACCO in Uganda today!

A SACCO (Savings and Credit Cooperative) in Uganda can be a fulfilling and impactful endeavor. However, the process involves careful planning, legal compliance, and effective management strategies. Therefore, this comprehensive guide will walk you through the essential steps to establish and run a successful SACCO in Uganda. From understanding the regulatory framework to creating a robust governance structure and implementing sound financial management practices. It will cover all the key aspects to help you navigate the journey of building a thriving SACCO.

Step 1: Understand the Regulatory Landscape before you Start or Run your SACCO

Before embarking on your SACCO journey, it is crucial to comprehend the regulatory framework governing SACCOs in Uganda. The SACCO should understand the legal requirements, and the registration process. Additionally, it is important to undrstand the role of regulatory bodies such as the Ministry of Trade, Industry. Other important bodies are the Ministry of Cooperatives and the Uganda Cooperative Alliance.

Step 2: Develop a Solid Business Plan when you Start the SACCO and use it when you Run it.

Secondly, a well-structured business plan is the foundation for any successful SACCO. The essential components of a SACCO business plan, include defining your vision and mission, conducting a market analysis. The SACCO founder should also outline the SACCO products and services, and develop a marketing strategy.

Step 3: Establish a Robust SACCO Governance Structure When You Start and Run the SACCO

Good governance is paramount to the long-term sustainability of a SACCO. In the SACCO it is important to have a strong board of directors. Moreover, effective governance policies, member representation, and the establishment of internal control systems are essential. Additionally, the SACCO hould have clear roles and responsibilities of key positions within the SACCO’s organizational structure.

Step 4: Ensure SACCO Regulatory Compliance

Fourthly, complying with legal and regulatory requirements is crucial for the smooth operation of a SACCO. Therefore, it is important to inquire about important tax regulations and obligations for SACCOs in Uganda. This article TAX that will provide an overview of tax obligations. Additionally, it gives information on compliance with financial regulations such as the Uganda Revenue Authority (URA).

Step 5: Implement Sound Financial Management Practices

Proper financial management is essential for the sustainability and growth of a SACCO. Therefore, explore key financial management aspects, including capitalization, budgeting, loan portfolio management, savings mobilization, investment strategies, and risk management.

STEP 6: Grow and Engage the Membership

Before you start and run a SACCO, building a vibrant membership base is essential for it to thriving. Therefore, vet your members well through ensuring you have similar goals and objectives. Moreover, you should have effective communication and engagement practices. Member education and training programs, and the importance of building trust and loyalty among members. Consequently, it will help build a strong relationship.

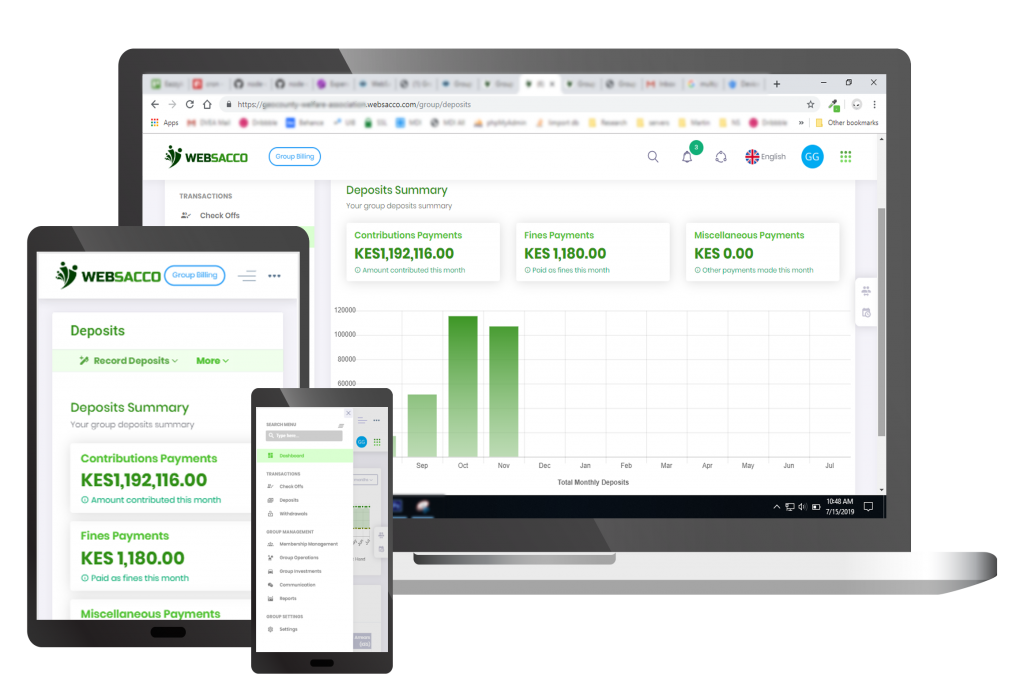

STEP 7: Leveraging Technology for Efficiency

In the digital era, adopting technology can significantly enhance the efficiency and service delivery of a SACCO. Therefore, you should explore various technological solutions. These include; core banking systems developed easily by companies like DVEA. SACCO management systems, online member portals, and data analytics portals provided by Websacco and Chamasoft. These technologies can streamline operations and promote transparency. Consequently, they improve member experience. Additionally, they help the SACCO you run mobilize more cheap deposits.

Conclusion

Conslusively, starting and running a SACCO in Uganda can be a rewarding journey. Additionally, it empowers communities and promotes financial inclusion. Follow the step-by-step guidance provided in this blog post. Consequently, you will be well-equipped to navigate the SACCO set up challenges. Additionally, you will seize the opportunities in establishing a successful SACCO that positively impacts the lives of its members.