The role of SACCOs in Kenya has led to the growth of Kenya’s economy over the decades. SACCOs are filling a gap in Kenya’s economy by providing alternative financial solutions, especially to the vulnerable. Thus, many more Kenyans can access financial services that they could not receive previously. Just like any other investment group, SACCOs can face challenges and struggle to remain afloat. However, SACCO managers can implement strategies that offer better strategies for SACCO growth. This article highlights the role of SACCOs in Kenya’s economy and what SACCO administrators can do to increase SACCO membership. Therefore, SACCOs will continue playing a greater role in economic growth and empowerment in the country.

What is the Role of SACOOs in Kenya’s Economy?

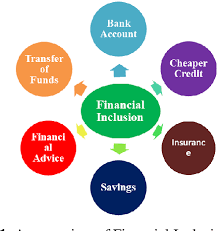

The main role that SACCOs play in Kenya’s economy is financial inclusion and providing alternative means to financial services. Traditionally, Kenyans would use a banking system that would not be readily available to everyone at all times. Thus, SACCOs step in to bridge the gap and include more vulnerable groups on board.

Therefore, the four main roles of SACCOs include the following:

1. Financial Inclusion in SACCOs.

inancial inclusion generally means giving different people in the community access to different financial services. Usually, SACCOs function to offer their financial services to people sharing the same goals or working in the same environment. For example, Ukulima SACCO mainly targets farmers who can invest and borrow from the SACCO. Thus, farmers who are members of the SACCO can grow their businesses to increase their yield as they continue investing. Such SACCOs offer better rates to farmers who may lack such services from traditional banking systems. Also, they can make transactions any day due to the proximity to the SACCO.

However, focusing only on one group is limiting to the SACCO’s growth and expansion. Currently, more SACCOs are opening their borders to include more people as they adapt and change with the times. That way, more people will join more SACCOs and enjoy better financial services from the SACCO of their choice. People with less access to financial services, such as the youth, will cultivate a better savings culture and better credit. The more SACCOs have high membership rates, the more the SACCOs grow and become more sustainable.

Gender equality is a crucial component of sustainable development. SACCOs recognize this fact by actively promoting women’s financial inclusion through various initiatives. They provide targeted financial services such as women-focused credit programs or training programs aimed at enhancing financial literacy among women. Thus, SACCOs offer financial inclusion to community members who previously did not have access to better financial services.

2. The Role of SACCOs to Promote Savings and Investments.

Another main role of SACCOs is to promote a positive savings culture to gain more financial access. Nowadays, many people see the younger generation as having a poor savings culture. However, most people lack the proper channels to save and invest their money, discouraging them from saving their money. Additionally, many lack the proper knowledge on how to make the right financial decisions, leading to poor investments.

Thus, SACCOs provide a better alternative that leads to personal finance management. Unlike traditional banking systems that promote excessive borrowing, SACCOs encourage more savings. Additionally, SACCO members must borrow for some time before they can access any credit from the SACCO. SACCOs will only give their members loans that match their savings for better financial management. Most people prefer borrowing from SACCOs because they offer members better rates and repayment terms. That way, SACCOs will reduce overburdening their members with loans and interests they cannot pay.

Also, SACCO members enjoy dividends from their savings, encouraging them to continue saving with the SACCO. SACCOs offer competitive rates on the members’ regular deposits, promoting more savings. Therefore, individuals wishing to join a SACCO must check the one that is the most suitable for them. SACCO members must understand the different rates that the SACCO applies and how much dividends they earn from their savings.

3. The Role of SACCOs in Small and Medium Enterprises (SMEs).

One of the important beneficiaries of SACCOs is the Small and Medium Enterprises (SMEs) in terms of loan access. SMEs are the backbone driving the economy since they generate more job opportunities, boosting economic growth. Previously, the traditional banking system would shun SMEs since they would generate lesser profits than bigger corporations. Now, SACCOs bridge the gap between SMEs and their loan access and provide affordable loans to grow their businesses.

SACCOs usually offer loans to SMEs by tailoring their terms to specific needs which a particular SME needs. For example, a local fruit processing plant may require a loan for machinery that will accommodate more fruits. The SACCO will step in and curate a loan that specifically applies to this business, offering better repayment terms. That way, the business will continue generating more income as they pay off their loans to the SACCO. The SACCO fosters economic growth by providing a chance for businesses to grow and create employment. Thus, SACCOs will directly boost Kenya’s economic growth.

4. Providing Financial Literacy.

Financial literacy is a key skill that many people lack, leading to poor finance management. Thus, many people end up making costly mistakes that cause losses to their businesses or become loan defaulters. However, SACCOs have taken it upon themselves to offer financial literacy to their members. That way, SACCO members will understand how to invest their money and save through better channels. Additionally, SACCO members will understand the benefits of investing in their SACCO.

SACCO administrators can organize different activities in which their members can participate. For example, SACCOs can conduct drives within the community that ensure community members receive proper financial literacy. Also, SACCO administrators can engage other financial advisors to offer financial knowledge to SACCO members. SACCOs must strive to target the youth who do not participate in such discussions within the community.

How to Improve the Role of SACCOs in the Community.

One of the ways SACCOs can increase the roles they play in our community is by digitising SACCOs. Proper fund management increases investing opportunities for all SACCO members. SACCO administrators will monitor all SACCO operations in real-time, providing transparency to all SACCO members. That way more members will join the SACCO since they will see and understand how their SACCO operates.

SACCO administrators can digitise their operations by using SACCO management software. Once the SACCO’s systems are online, SACCO administrators will minimise bulky bookkeeping records. Additionally, SACCO managers will avoid risks to the SACCO since the software offers risk management strategies. SACCO managers will implement these strategies and boost their investments by monitoring and avoiding risks.

SACCOs can also engage in community programs which increases the unity between the SACCO and the community. Thus, community members will see that the SACCO has the best intentions for all community members. SACCO administrators can achieve this by engaging in community projects such as engaging in environmental conservation activities. Therefore, the SACCO will work to create a stable and sustainable environment in which the community can thrive.

Conclusion

In conclusion, Savings and Credit Cooperative Societies (SACCOs) hold immense significance in Kenya’s economy. Their contribution towards financial inclusion efforts targets individuals who traditionally lack access to mainstream banking institutions. Considering their wide reach across various regions in Kenya, SACCOs will continue being instrumental players in shaping country-wide economic health.

The role of SACCOs will remain significant since they bridge the gap between the community and financial access. The greatest impact of SACCOs is ensuring the most vulnerable in society have better loans and savings platforms. That way, more SACCO members will receive better financial knowledge for better personal financial management.