Year: 2019

Finance

General

SACCO

SACCO Software

Deciding Which SACCO to Join

Finding the right Sacco in Kenya, one that meets your goals is essential, not only for your financial growth but also for the safety of your money. It is, therefore, vital to do your homework beforehand to ensure you’re settling for the best deal. There are unlimited options for Saccos in Kenya, which is an excellent thing because […]

Read More

Finance

SACCO Software

How Secure is Your Money with Your Sacco

Some people have lost money in rogue Sacco that has conned people of their savings. This is not a trend in Kenya but neither should it deter you from saving in a Sacco, if you wish to. To begin with, Sacco is a great initiative that has seen many people save money and access loans at […]

Read More

Finance

General

SACCO

SACCO Software

Difference between SACCOs and Microfinance

Are you interested in starting a business? Then you need resources and capital. So what do you do? If you are like most Kenyans, you head to your bank and inquire about a loan. While you may successfully get a loan, if you are considered low-income, the odds are you will be denied. That’s where […]

Read More

Finance

General

SACCO Software

Predatory Lending among Digital Lenders

Mobile loan borrowing has been on the rise across Kenya. With growing smartphone availability and easy access to mobile money transfer and quick application turnaround, digital credit has sky-rocketed in this country. Mobile company Safaricom’s M-Pesa is a well-known example. It is no surprise; therefore, that digital lending has developed so strongly in Kenya. However, it’s not […]

Read MoreFinance

General

SACCO

SACCO Software

How to Know if Your SACCO is a Deposit Taking SACCO or not

Savings and credit co-operatives (Saccos) have come under increasing public scrutiny of late, mostly on charges of loss of member funds. Let’s first understand Saccos; and to do that, we have to start with the co-operative movement. Co-operatives are defined as an independent association of persons united with a purpose to meet their common economic, […]

Read More

SACCO

Why SACCOs Should Adopt Cloud Solutions

Small Savings and Credit Co-operative Societies (SACCOs) can now eliminate the cost of buying computer servers and employing ICT personnel by tapping into cloud-based servers. It costs SACCO’s between Sh 800,000 and Sh 2 million to acquire computer servers. This has made it difficult for small SACCO’s to leverage on technology to cut costs and […]

Read More

General

SACCO

SACCO Software

Which SACCO to Join? Credit Only or Deposit Taking SACCO?

How to know if your SACCO is a deposit-taking SACCO or not Savings and credit co-operatives (SACCOs) have come under increasing public scrutiny of late, mostly on charges of loss of member funds. Let’s first understand SACCOs; and to do that, we have to start with the cooperative movement. Co-operatives are defined as an independent […]

Read More

SACCO

SACCO Software

Why Saccos should adopt a Cloud Based IT Platform

Why Saccos should adopt cloud solution. Small Savings and Credit Co-operative Societies (SACCOs) can now eliminate the cost of buying computer servers and employing ICT personnel by tapping into cloud-based technology. It’s quite pricey to set up initially if a SACCO is to use on-premise technology. The initial CAPEX has made it difficult for small […]

Read More

SACCO Software

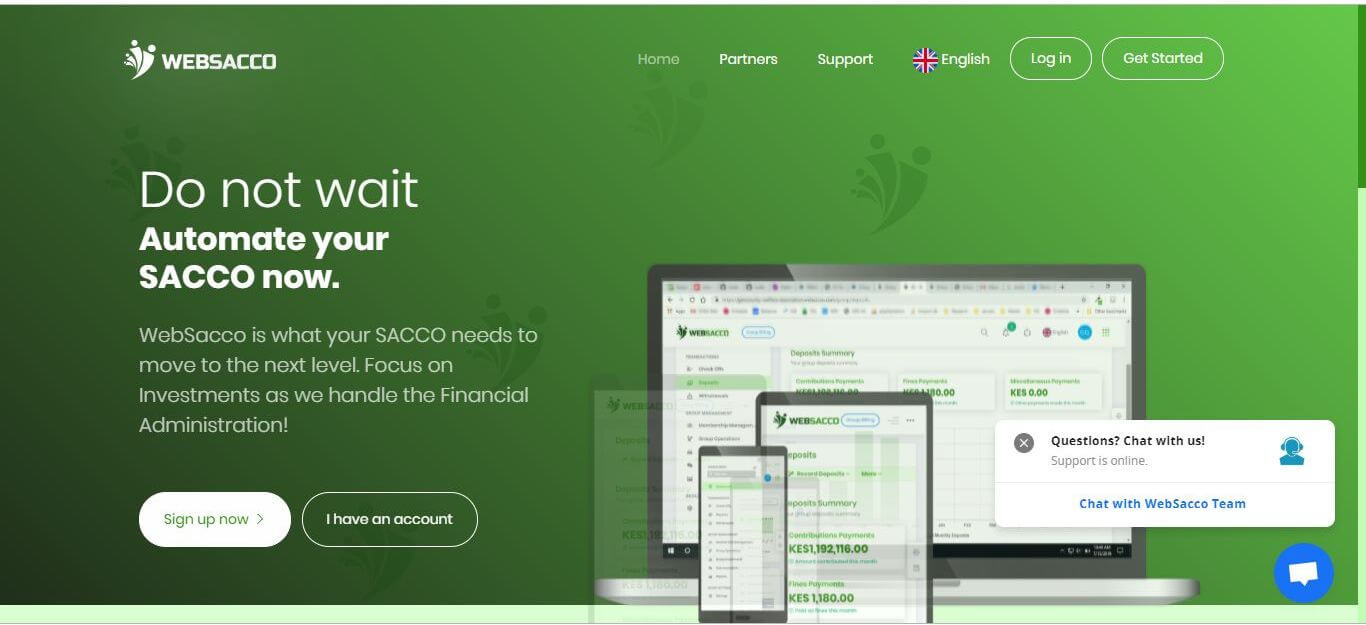

WebSacco

Why we built WebSacco

WebSacco is a new cloud platform for SACCOs who want to go online and on cloud and serve their customers in a better way by adopting easy to use technologies.

Read More