Introduction

Savings and credit cooperatives (SACCOs) offer a variety of investment options to their members. Different types of Sacco investments can help members to save money, grow their wealth, and achieve their financial goals.

Here are some of the different types of SACCO investments:

Fixed deposits:

Fixed deposits are a type of investment where members deposit a certain amount of money for a fixed period of time, such as 3 months, 6 months, or 1 year. In return, members earn a fixed interest rate on their deposit. Fixed deposits are a good option for members who are looking for a safe and predictable investment.

Shares:

SACCOs also offer shares to their members. Shares are a type of investment where members own a part of the SACCO. Shareholders are entitled to receive dividends, which are a portion of the SACCO’s profits. Shares are a good option for members who are looking for a long-term investment with the potential for higher returns.

Bonds:

SACCOs also offer bonds to their members. Bonds are a type of loan that members make to the SACCO. In return, the SACCO pays members interest on the loan. Bonds are a good option for members who are looking to lend money to the SACCO and earn interest on their investment.

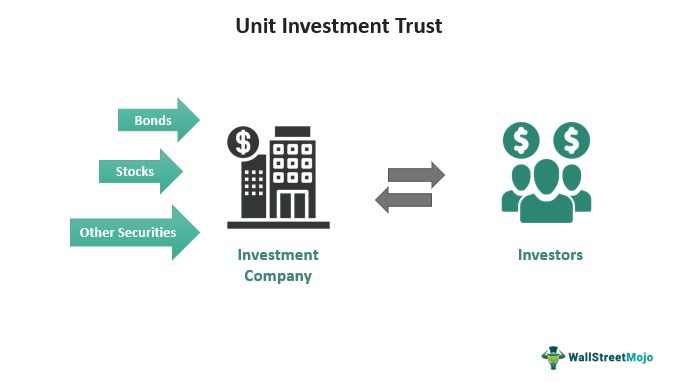

Unit trusts:

SACCOs also offer unit trusts to their members. Unit trusts are a type of investment fund that invests in a variety of assets, such as stocks, bonds, and real estate. Unit trusts are a good option for members who are looking for a diversified investment with the potential for higher returns.

Real estate:

Some SACCOs also invest in real estate on behalf of their members. This can include investing in commercial properties, residential properties, or land. Real estate can be a good investment option for members who are looking for a long-term investment with the potential for capital appreciation and rental income.When choosing a SACCO investment, it is important to consider your individual financial goals and risk tolerance. You should also research the SACCO’s investment options carefully and understand the risks involved.

Here are some tips for choosing the right SACCO investment:

Consider your financial goals:

What are you saving for? Do you need to save for a short-term goal, such as a down payment on a house, or a long-term goal, such as retirement? Once you know your financial goals, you can choose an investment that will help you achieve those goals.

Consider your risk tolerance:

How much risk are you comfortable taking? Some investments are riskier than others. It is important to choose an investment that is appropriate for your risk tolerance.

Research the SACCO’s investment options:

Before you invest, it is important to research the SACCO’s investment options carefully. This includes understanding the risks involved and the potential returns.

Seek professional advice:

If you are unsure which SACCO investment is right for you, you should seek professional advice from a financial advisor.

Conclusion

SACCO investments can be a great way to save money, grow your wealth, and achieve your financial goals. By choosing the right investment for your individual needs and circumstances, you can make the most of your SACCO membership. However, it is important to carefully consider your financial goals and risk tolerance before investing. You should also research the SACCO’s investments carefully and understand the risks involved. In addition, you should seek professional advice from a financial advisor if you are unsure which SACCO investment is right for you.