SACCOs play a vital role in empowering individuals and communities by promoting financial inclusion, savings, and investments. However, challenges faced by SACCOs can hinder their growth and effectiveness. Understanding these challenges and identifying strategies to overcome them is crucial for the success and sustainability of SACCOs. Here are some common challenges and potential solutions

Limited Financial Resources:

One of the significant challenges faced by SACCOs is the availability of limited financial resources. Consequently, it can be difficult to mobilize sufficient funds for lending, investment opportunities, or meeting operational expenses. However, there are strategies SACCOs can employ to overcome this challenge. Firstly, they can focus on increasing membership and actively encouraging regular savings contributions. Additionally, exploring partnerships with financial institutions can provide access to additional funds. Moreover, SACCOs can consider seeking grants or funding from government programs or donor agencies to supplement their financial resources.

Governance and Leadership Issues:

Weak governance structures and ineffective leadership can hinder the growth and stability of SACCOs. Lack of transparency, accountability, and strategic planning can lead to mismanagement and conflicts within the organization. To address this challenge, it is essential to establish robust governance frameworks, elect competent leaders, and provide training on leadership, financial management, and decision-making. Regular audits and performance evaluations can also ensure accountability and transparency.

Member Education and Participation:

SACCOs rely on active member participation and engagement. However, members may lack financial literacy or a clear understanding of the organization’s operations, products, and services. This challenge can be overcome by prioritizing member education and awareness programs. Workshops, training sessions, and regular communication channels can help members understand the benefits of participation, make informed financial decisions, and actively contribute to the organization’s growth.

Risk Management and Loan Defaults:

SACCOs face the risk of loan defaults, which can adversely impact their financial stability. Transitioning to mitigating this challenge, inadequate risk management systems, weak credit assessment processes, or economic downturns can contribute to higher loan default rates. To address this, SACCOs should establish and implement robust risk management policies and procedures. These measures include conducting thorough credit assessments, in addition to setting appropriate loan terms and conditions. Moreover, monitoring loan repayments diligently and implementing effective recovery strategies are crucial steps in ensuring financial stability and minimizing loan defaults. By adopting these risk management practices, SACCOs can safeguard their financial stability and minimize the impact of loan defaults.

Regulatory Compliance:

Compliance with regulatory requirements and legal frameworks is crucial for the sustainability and credibility of SACCOs. However, amidst complex regulations, maintaining compliance can pose challenges, particularly for smaller organizations. To effectively navigate this landscape, it is essential to stay updated on regulatory changes, seek legal advice if necessary, and establish robust internal systems and controls. Additionally, collaborating with regulatory bodies and industry associations can offer valuable guidance and support in overcoming compliance challenges. By proactively addressing these considerations, SACCOs can uphold their credibility and ensure long-term sustainability within the regulatory framework.

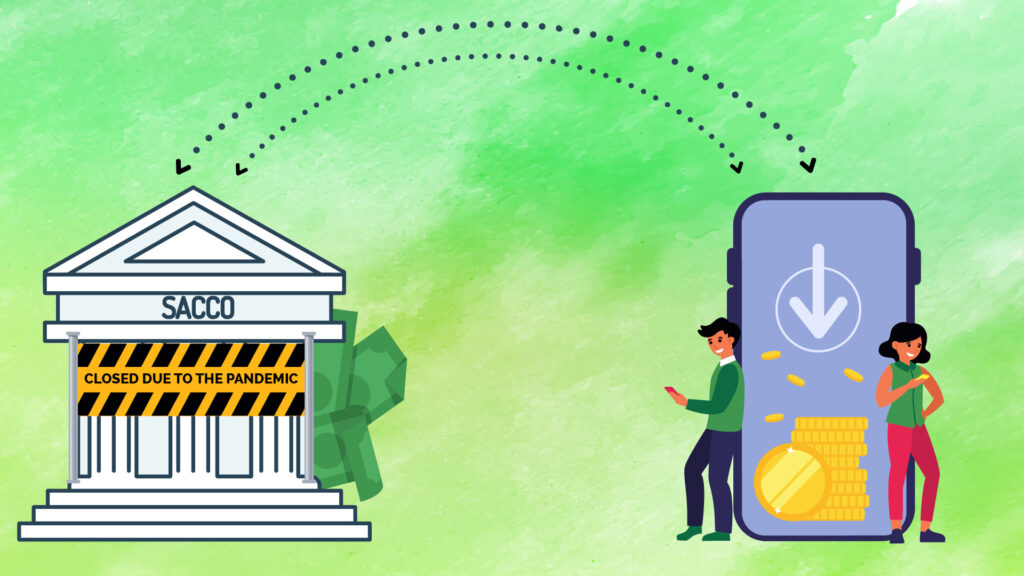

Technology Adoption:

Rapid technological advancements present both opportunities and challenges faced by SACCOs. On one hand, adapting to new technologies can significantly improve efficiency and enhance the member experience. However, on the other hand, limited resources, lack of technical expertise, and resistance to change can pose obstacles to technology adoption. To overcome this challenge, SACCOs need to invest in robust technology infrastructure, provide comprehensive training to staff and members, and foster a culture of innovation and adaptability. By doing so, they can embrace the benefits of technological advancements and position themselves for continued success in the digital era.

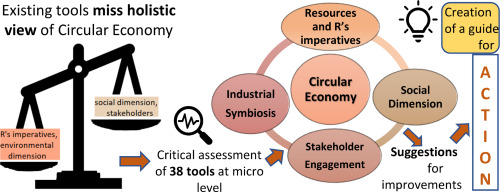

External Economic Factors:

SACCOs are influenced by external economic factors such as inflation, interest rates, and market volatility. Moreover, economic downturns can significantly impact member savings, loan repayment capacity, and investment returns. To effectively mitigate the impact of these external factors, SACCOs should prioritize maintaining diversified investment portfolios. Additionally, conducting regular risk assessments and adjusting interest rates and lending practices based on market conditions are crucial. Furthermore, building financial reserves during favorable economic periods can provide a much-needed buffer during challenging times.

Conclusion

By addressing these challenges faced by SACCOs, and implementing appropriate strategies, organizations can enhance their resilience, sustainability, and ability to meet the financial needs of their members. This entails proactive planning, effective governance, active member engagement, robust risk management, strict compliance, and embracing technology. By overcoming these challenges, SACCOs can not only sustain their valuable contributions to financial inclusion and community development but also thrive in an ever-changing landscape.